With the release of the Panama papers, attention is very much focused on tax and offshore accounts. What’s maybe not so widely known is that the last two Prefab Sprout albums were essentially financed by tax evaders. It was essentially the same scheme Gary Barlow and Take That were involved in and which was ruled illegal in 2014.

With the release of the Panama papers, attention is very much focused on tax and offshore accounts. What’s maybe not so widely known is that the last two Prefab Sprout albums were essentially financed by tax evaders. It was essentially the same scheme Gary Barlow and Take That were involved in and which was ruled illegal in 2014.

Let’s be clear that neither Paddy nor Keith Armstrong from Kitchenware are tax evaders, at least as far as I know. They had nothing to do with what I’m about to describe, they were just flogging their art as usual.

When the album was up for release I did a little digging into Icebreaker, and was fascinated to find that it was being sold as an investment opportunity where the minimum investment was £250K, typically there would be 10-20 investors, and about 80% of the investment was expected to be borrowed. This raised my suspicions a bit, and I commented on it on the Sproutnet forum, towards the bottom of the page – happy to say I’d got the mechanics pretty much spot on.

How it worked was deliciously complex, with several parties involved, and close involvement by an offshore bank.

Let’s say we have 10 investors, each investing £500K, total of £5M. Of this, each invests £100K of their own money, and arranges a loan of £400K. This forms a partnership, or LLP.

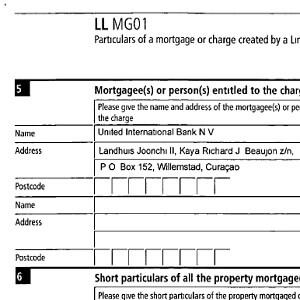

The important point here, is that the loans were arranged by Icebreaker, on identical terms for each investor, and had to be with a particular bank. In the case of “Crimson/Red”, this was a bank in Curacao, the “United International Bank”. For “Lets Change the World With Music” this was S G Hambros in the Channel Islands.

On the day the partnership forms, lots of things happen. The bank releases the loan funds to the investors, who add their own cash and send it to Icebreaker. Icebreaker retain substantial fees, and pay a total of 2.4% of the loan amount to the bank, which is how the bank makes money. The remander is put to the credit of the LLP. At this point there will be an amount equal to the loan plus a comparatively small surplus, with the fees coming out of the “real” money.

Icebreaker, who have a power of attorney for the LLP, then pay the artist – Paddy in this case – something like £5K for the rights to the intellectual property forming the production. Don’t worry though, he gets more later.

They then – again on behalf of the LLP – pay almost all of the remainder from the LLP account to another company to exploit the intellectual property. For “Let’s Change the World With Music” this was Shamrock Solutions. Shamrock is actually a genuine exploitation company, i.e. it really worked to maximise returns from products and genuinely worked with the artists, but it was tied to Icebreaker by various contractual requirements. They weren’t frantically successful at exploiting work for profit, but they were genuine, and they tried hard. I’m not sure who did “Crimson/Red”, but it was the same structure. Let’s assume it was Shamrock for the sake of the explanation.

Shamrock then pays a large production fee to the artist’s company. Let’s say £1.8M. However the artist has to buy the rights to receive a percentage of proceeds, typically 50%. This could be £1.5M, leaving a net to the artist of £300K which is the actual production cost. This payment structure is expected and mandatory, it is a means of making the production costs look comparable to the amount paid by Icebreaker, when in fact they’re a small fraction. In fact although both amounts are invoiced, only the net amount is transferred.

Shamrock then are still holding a large amount of net cash from the LLP. So they take an amount exactly equal to the aggregated loans and deposit it with the same bank that lent it in the first place, with the bank having first charge on the deposit. The remainder is held to pay for the exploitation of the rights, marketing and so on. If they make a profit, some passes back to the LLP. Though that rarely if ever happened. The stated aim of this deposit is to provide security to the bank and investors in case the exploitation company folds, which as it happens it does, but the real reason is to offset the loans so the actual net cost to investors is zero.

So you can now breathe in… The positions are as follows:

- The investors have each put £100K of their own money in

- The bank has taken 2.4% of £4M = £96K

- The bank has lent out £4M to the investors but taken deposits of £4M from Shamrock which it has first call on if the investors don’t pay interest. It has therefore made £96K at zero risk for moving a number from one part of the balance sheet to another. Banks, eh?

- Icebreaker has taken a large fee from the investors and has no further interest in the success or failure of any project

- Icebreaker has paid well over £4M to (say) Shamrock – let’s say £4.5M – on behalf of the LLP

- Shamrock have paid (say) £1.8M to Paddy, but received £1.5M back instantly, net £300K and they have net funds (£200K) to exploit the resulting project. They also paid £4M into a deposit account they can’t get at, but that’s irrelevant to them.

- Paddy is up £305K and has transferred the rights to his work to the LLP – he will also receive 50% of net revenue.

- The LLP is left with a tiny residue. A few 10s of K.

If this was all there was to it, the investors would be praying for a highly successful project to get their own “real” money back.

But it isn’t.

Because of the large £4.5M payment to Shamrock, the LLP and therefore the investors has made an enormous year one trading loss. Which can be offset against income and capital gains tax for the last three years for each of the investors and more than pays back the cost of the “real” money. The investors don’t need a successful project, because they’re £20k to £60K up, courtesy of the taxpayer.

Moreover the bank pays and charges interest on the £4M at the same rate in both directions, and Shamrock are obliged to pay the interest they receive to the LLP. Who pay the bank. Net cost, zero. Risk, zero. At the end of the arrangement, Shamrock pay the capital back to the LLP which pays off the loans. So the borrowing exists only to inflate the tax loss.

It’s designed to look like a set of genuine transactions, and in fact the companies were operating at “arms length” but under the constraints of specifically and carefully designed agreements that removed risk and maximised tax “efficiency”. The practical upshot is that the investors had a guaranteed profit, zero risk, and a chance of a windfall profit from the resulting albums (although few if any Icebreaker projects made money).

In essence, the taxpayer picked up the tab for the albums. Instead of funding, say, care payments for the disabled or the NHS or deficit reduction. That’s why people get justifiably angry with Gary Barlow. But it wasn’t just him, there were upwards of 900 individuals doing this. Some were famous, some were just relatively high net worth individuals who’d been sucked in by the promises and been reassured by their financial advisors that it was above board.

And they would have gotten away with it, except that the pesky HMRC stepped in and had it stopped. They’re probably still trying to get the money back from the investors. If you’re interested, you can read the court document, which is fascinating, lengthy, but fascinating. And you can see the details of the LLPs including investors, Purplesun LLP for “Let’s Change the World with Music”, and Caldergrave LLP for “Crimson/Red”. I looked some of them up – one seems to be the CIO of Nissan, but rather amusingly it seems “Crimson/Red” was largely funded by a consortium of Orthodontists. Which given that getting Paddy to record is like pulling teeth seems more than a little appropriate…

But we’re left with an interesting question. Are we pleased these albums were released, even via tax evasion, or would we rather they were left unfunded but morally pure?

Not sure I can answer that myself.

I’m afraid I don’t have an answer to your final question but just wanted to say thanks for a great piece of analysis. Just goes to show how those without any kind of moral compass will find ways to work the rules to their own advantage. HMRC are struggling to catch up and unfortunately it is much easier to chase those without the wherewithal to enter into complicated schemes like this. Let’s hope they pursue the principle that if an arrangement has no legitimate purpose or commercial logic other than to avoid tax then it should be unwound.

HMRC did a great job on this – these things are horrifically complex and take a lot of time to unravel. That’s why it’s a bit dumb when people say that there are many more people chasing benefit fraud than tax evasion: tax evasion is extremely specialised and it needs a small number of specialists to detect. When detected it takes a long time to work through. The judge’s comments in the opening section about the complexity of submissions says a lot.

Excellent synopsis I commend the investigators. I am glad the albums came to light regardless of means, yes that makes me horrible but such is the truth for me

Byzantine – great investigative reporting.

Paddy is an incredible singer/songwriter, and deserves every penny, but this is gross and shameful.

Then again, this is the music business currently chronicled in “Vinyl.”

Neoliberal tax evaders are everywhere, and none of us can guarantee moral purity for any of the dollars that have flowed our way.

Have Paddy donate a few bucks to Corbyn, and we’ll cal it even.

The other way of looking at this is that the system is working – tax evasion happens at the margins, and HMRC do a better job than people give them credit for in terms of spotting and stopping aggressive schemes like this. There is a standard meme that explains that far fewer people are employed stopping tax evasion than “benefit fraud”, which is true, except that HMRC investigations are highly specialised and don’t need many people, those they use are very skilled. What takes time is getting through the courts – this is a scheme that started in the early 2000s.

The big lesson from that is that the tax system is ridiculously complex, and a lot of the complexity comes from political posturing and virtue signalling on both sides. It would be fair to point out that much of what has been done to tighten up on offshore banking loopholes has been done since 2009, not I suspect for virtuous reasons but because the government needed the money.

The money will presumably be charged back to the Treasury so ultimately it’s the investors who have paid. I’m not sure whether there’s an ongoing appeal but from what I can see the investors are suing various groups they feel gave poor advice. To be fair to them, it’s quite likely this was presented as a low risk way of getting a chance of participation in a successful project, and they may have had altruism in mind. When you explain the mechanics it looks incredibly dodgy, and that was my reaction in 2013 when I looked at it, but I’m analytical and look at detail. Most people don’t.

Corbyn really just represents other vested interests, and from my perspective misrepresents a lot of things deliberately, especially around corporate taxation – essentially this is a tax either on consumers or pensions, profits coming from one or mostly going to the other – and the “tax gap” which isn’t a pot of unclaimed money, it’s essentially a time shift of receipts and litigation. I’m not going to go into details on either, and I don’t want to politicise the blog – I wish a plague on both their houses to be perfectly honest – but the point is both sides of the argument misrepresent taxation to play to their own particular gallery. And by doing that they create loopholes for the unscrupulous by introducing more complexity.

My head is still spinning. Great piece here. Thanks very much! At the end of the day, though, I am happy for Paddy to release his music by any means necessary – even if he has to bankrupt a few governments in the process.

Great read and analysis. Love how you manage to make the sprouts part of the current affairs 🙂 As you seem to know your economics from our finances; is there anyway to stipulate how much money Paddy and the band have made from Prefab?

I couldn’t put a figure on it, but I suspect the band didn’t make more than a salary for the time they were active and on the payroll. Paddy will have made more because of publishing rights, and there is what Andy Partridge describes as the “long tail” of the business which brings money in over a period of time after active work has finished. He’ll have made a good deal from the Jimmy Nail and Cher collaborations, plus “Where the Heart Is”, and I heard the Boots commercial with “King of Rock’N’Roll” brought in £50K. The Icebreaker deals, murky as they were, were also probably fairly lucrative for him personally – the interesting aspect being the profitability of the projects being secondary, the LLPs could afford to pay a lot to the artist, and it was in their interest to make them look like big deals.

There’s a sort of unspoken “hope” with fans of reclusive performers, which is that artists will eventually be starved back to releasing something or performing. It’s a bit selfish, but I doubt anyone wanting to hear more from Paddy hasn’t let it cross their mind from time to time. Anyway I doubt it’ll happen.